The dangers of leveraged trading under erratic market circumstances were highlighted when a major cryptocurrency trader, referred to as a whale, lost almost $308 million on a leveraged Ether position.

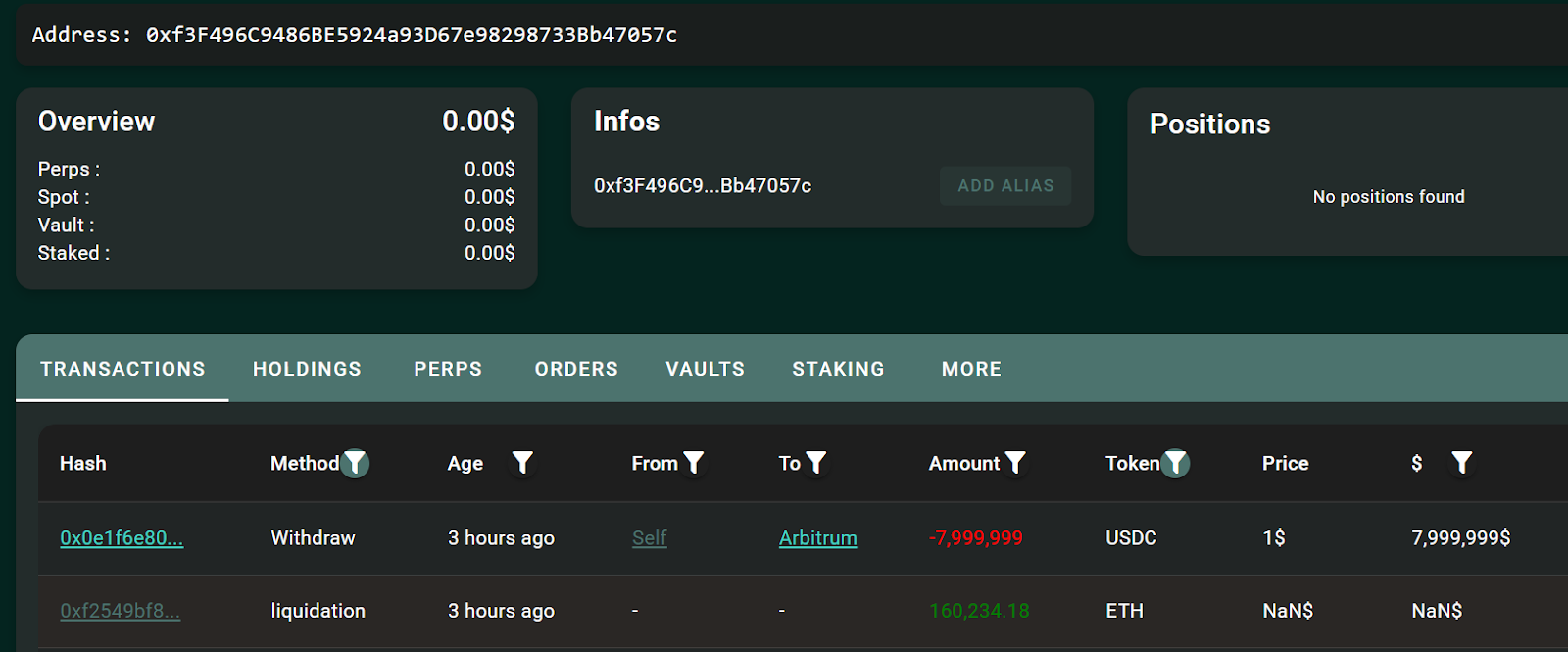

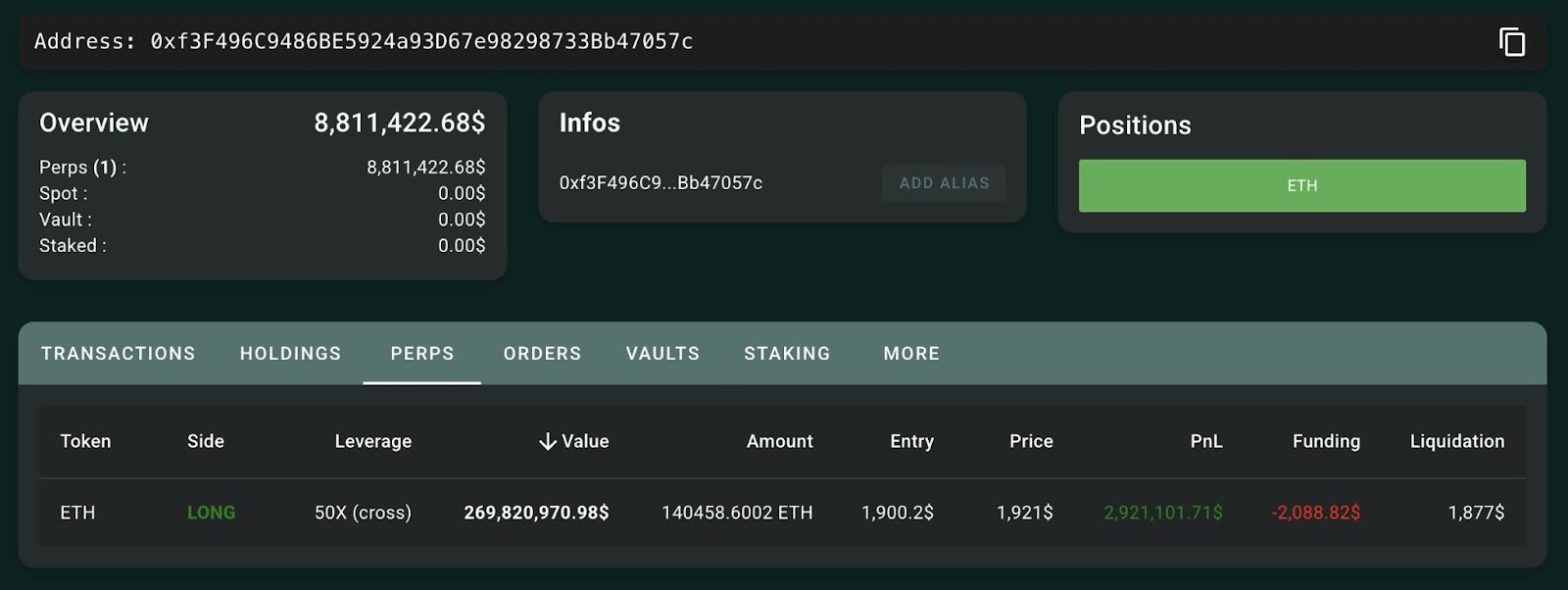

The unidentified cryptocurrency trader’s 50x leveraged long bet for more than 160,234 ETH was liquidated.

$1,901, which at the time of writing was valued at over $308 million, according to Hypurrscan statistics.

Leveraged trading is riskier than traditional investing positions because it uses borrowed funds to raise the amount of an investment, which can increase the size of wins and losses.

According to onchain intelligence firm Lookonchain, the whale had rotated all of his Bitcoin

BTC$82,904 holdings into the leveraged Ether trade before suffering the liquidation.

The liquidation occurred amid a time of increased volatility, as fears about the global trade war brought on by the most recent retaliatory tariffs from the European Union are limiting both the cryptocurrency and regular markets.