The idea of a crypto “altseason” may have changed significantly as a result of Bitcoin exchange-traded goods.

The cryptocurrency market has a well-known rhythm for years, a rather predictable dance of capital rotation. Bitcoin (BTC)

After $84,260 spiked, garnering liquidity and widespread attention, cryptocurrencies were able to flourish. In what traders ecstatically referred to as altseason, speculative capital poured into lower-cap assets, boosting their valuations.

Nevertheless, this cycle exhibits indications of a structural breakdown after being taken for granted.

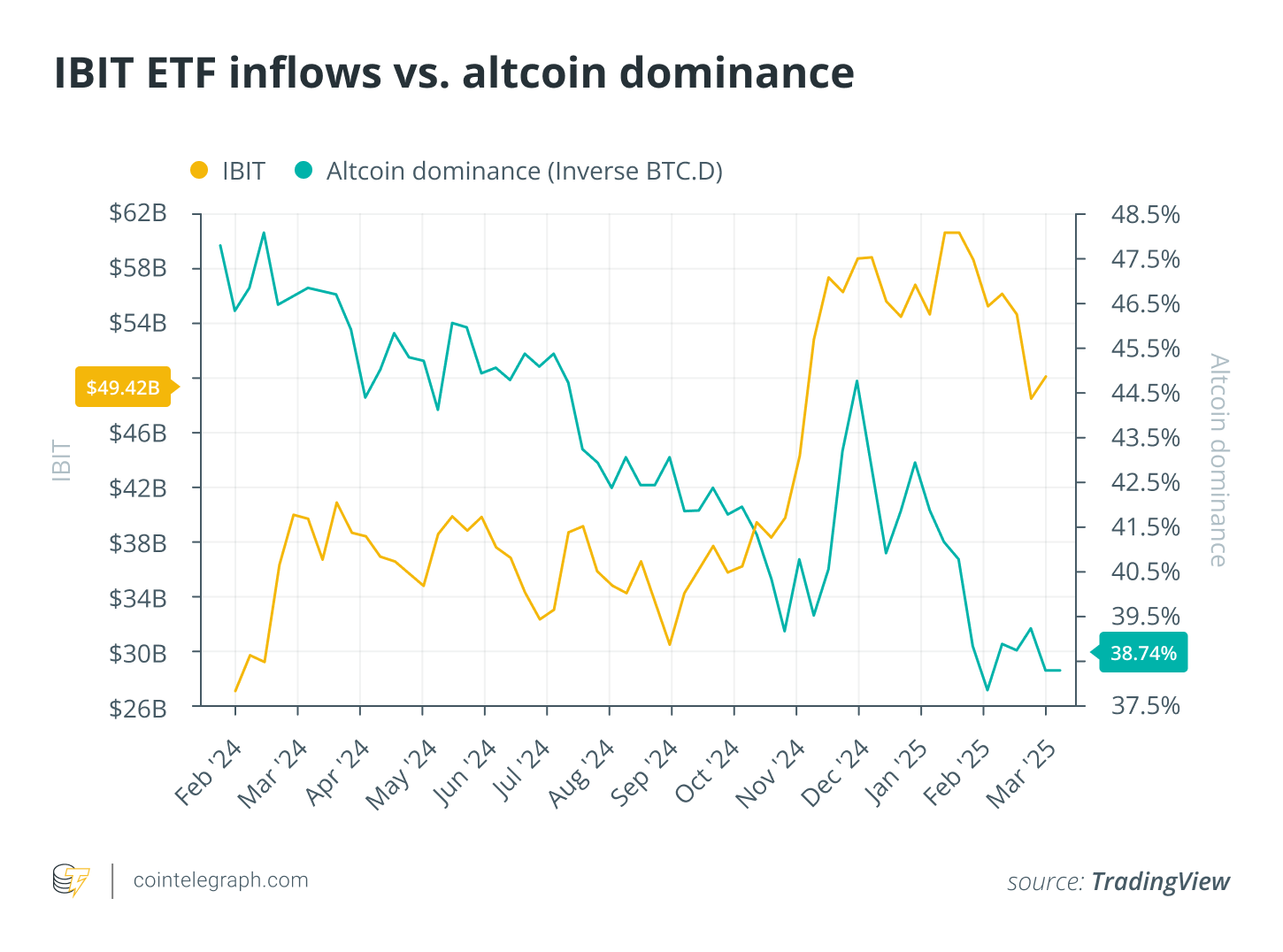

In 2024, spot Bitcoin exchange-traded funds (ETFs) broke all previous records by bringing in $129 billion in money. This has given institutional and individual investors access to Bitcoin like never before, but it has also left a void and diverted funds from speculative assets. Without the Wild West hazards of the altcoin market, institutional entities now have a controlled, secure approach to get involved in the cryptocurrency space. ETFs are also becoming more attractive to many individual investors than the risky pursuit of the next 100x coin. Plan B, a well-known Bitcoin expert, even exchanged his real Bitcoin for a spot ETF.

The motivation to risk on illiquid, low-volume cryptocurrencies is greatly reduced when options and futures may be used to hedge. The record $2.4 billion in withdrawals in February and the arbitrage opportunities brought forth by ETF redemptions have further supported this, bringing a hitherto nonexistent level of discipline to the cryptocurrency markets.