Bitcoin ($83,042)

According to recent study, investors who purchased Bitcoin in 2020 or later are still holding out for greater values.

According to research released on X on April 1, onchain analytics company Glassnode found that many hodlers would not sell for $110,000.

2020 Bitcoin purchasers “still holding,” according to Glassnode

Despite substantial increases in the price of Bitcoin, investors who first entered the market three to five years ago have kept their holdings.

With a cost basis that ranges from the 2020 lows of $3,600 to the 2021 highs of $69,000, Glassnode claims that this investment cohort is still hodling.

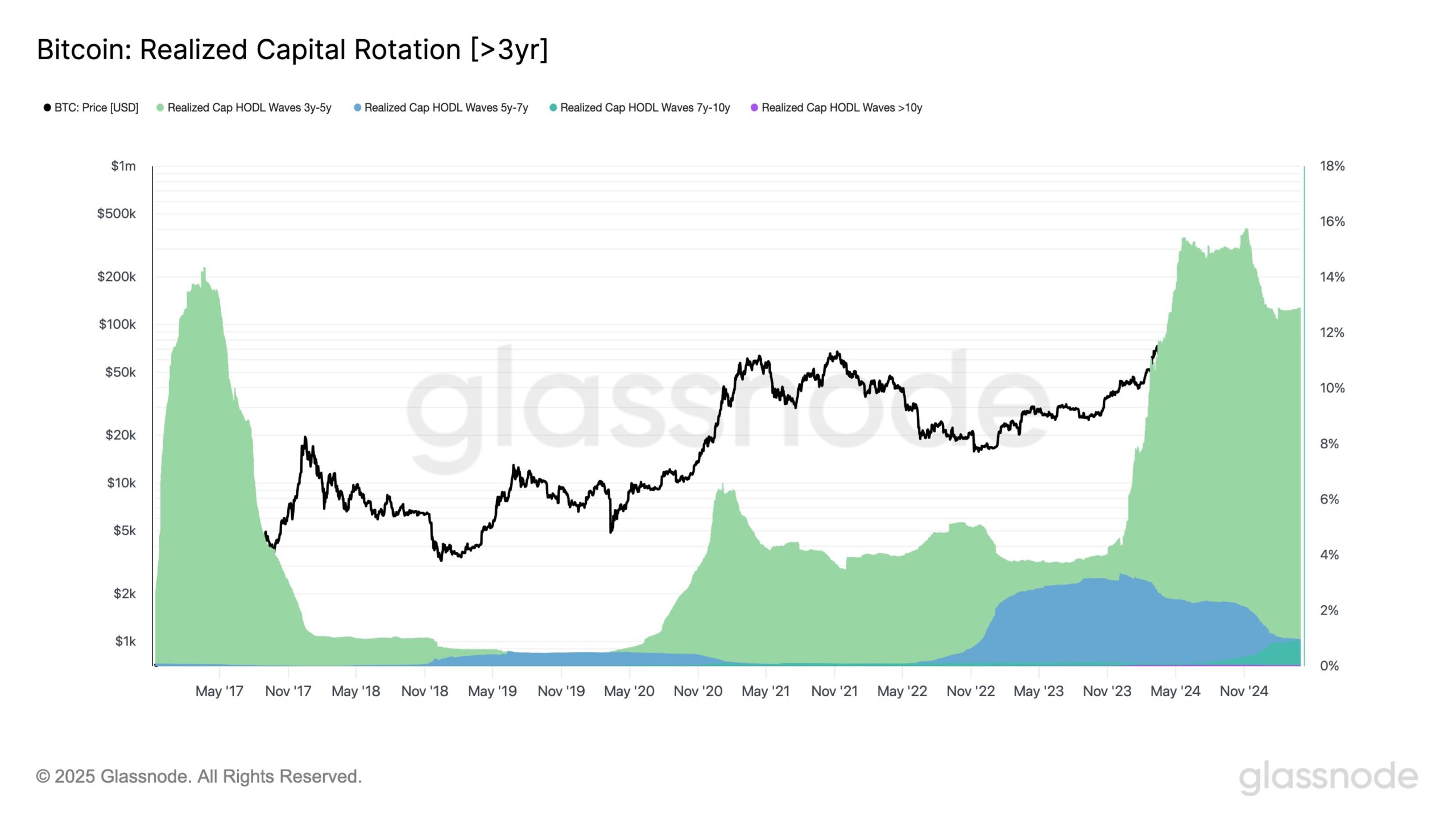

It stated that although while the portion of wealth owned by investors who purchased Bitcoin three to five years ago has decreased by three percentage points from its peak in November 2024, it is still at historically high levels.

Data from the Realized Cap HODL Waves measure, which divides the Bitcoin supply into segments according to when each coin last moved onchain, is displayed in the following graphic.

This allows Glassnode to differentiate between the consumers of 2020–22 and those who arrived right before them.

As a result of their reduced cost base, it indicates that more over two-thirds of people who had purchased Bitcoin five to seven years prior sold their holdings by the December 2024 high.